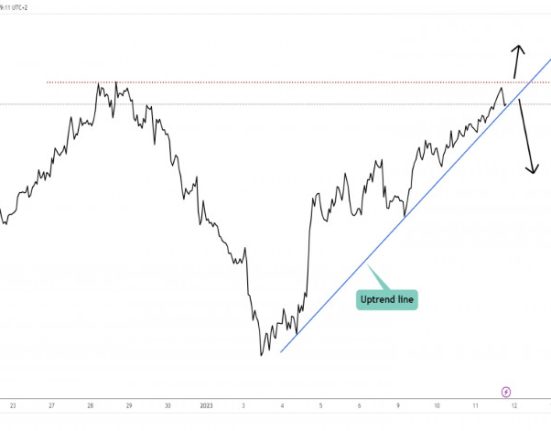

Examining the GBP/USD on January 12, 2023 through indicator analysis

Analysis of the trend The pound-dollar exchange rate may increase from the 1.2144 level (which was the closing of the prior day’s candle) to 1.2214, the 61.8% Fibonacci retracement point (indicated by the red dotted line). If this level is tested, further growth could be seen up to 1.2301, the.