Take control of market volatility

and sharpen your trading edge with ease.

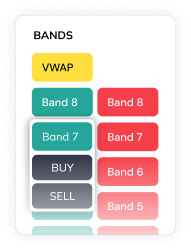

Auto-generate customized trading bands based on your strategy.

Tools

Unlock Your Trading Potential with Our Suite of Cutting-Edge Tools: Empowering You to Analyze, Strategize, and Execute with Confidence

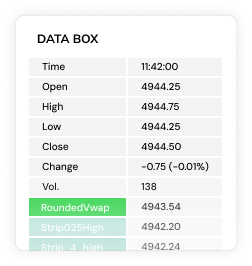

Market summary

Education/Strategies

Explore trading strategies and educational articles for beginner, intermediate, and advanced traders to enhance your skills.

22

Nov

The Art of Scaling In and Out of Trades: Maximizing Profit Potential

Scaling in and out of trades is an advanced trading strategy that allows traders to adjust their positions dynamically, reducing risk while maximizing profit potential. By breaking entries and exits into smaller steps, traders can better navigate unc...

22

Nov

The Science of Trend Analysis: Spotting Market Direction with Confidence

Understanding market trends is one of the most fundamental yet powerful aspects of trading. By identifying whether the market is moving upward, downward, or sideways, traders can align their strategies with the overall momentum, avoid costly mistakes...

15

Nov

Decoding Candlestick Patterns: A Guide to Price Action

Candlestick patterns are a cornerstone of technical analysis, providing traders with visual cues about market sentiment and potential price movements. By mastering candlestick patterns, traders can interpret price action more effectively, identify tr...

15

Nov

The Evolution of Trading Technology: Past, Present, and Future

Trading has come a long way from shouting orders in crowded pits to executing trades at the click of a button. Over the decades, advancements in technology have revolutionized the way traders interact with markets, analyze data, and execute strategie...

15

Nov

The Basics of Swing and Position Sizing in Trading

Effective trading isn’t just about identifying opportunities; it’s about managing risk and maximizing rewards. Swing trading, in particular, relies heavily on maintaining a balance between these factors. One of the most crucial elements of this balan...

04

Nov

Position Sizing: How to Balance Risk and Reward

Position sizing is one of the most critical, yet often overlooked, aspects of successful trading. While choosing the right assets and determining entry and exit points are essential, how much capital you allocate to a trade can significantly impact y...

04

Nov

The Role of Sentiment Analysis in Modern Trading

Sentiment analysis is becoming an increasingly important tool in modern trading. While traditional technical and fundamental analyses focus on market data and economic indicators, sentiment analysis goes a step further by assessing the mood of the ma...

04

Nov

The Importance of Liquidity in Trading: What Every Trader Should Know

Liquidity is one of the most fundamental concepts in trading, but it’s often overlooked by traders who focus solely on price movements or trends. In simple terms, liquidity refers to how easily an asset can be bought or sold in the market without aff...

31

Oct

The Basics of Hedging in Trading

Hedging is a risk management strategy used to offset potential losses in an investment by taking an opposite position in a related asset. While hedging doesn’t prevent loss, it minimizes exposure to unfavorable market movements. Common hedging instru...

31

Oct

Market Sentiment Analysis: Gauging Investor Mood

Market sentiment is the overall attitude of investors toward financial markets, representing whether investors feel optimistic (bullish) or pessimistic (bearish) about market trends. Sentiment analysis helps traders understand how collective psycholo...

31

Oct

The Role of Economic Indicators in Market Movements

Economic indicators are data points released by government agencies and private organizations that provide insights into the current economic conditions. Indicators such as Gross Domestic Product (GDP), Consumer Price Index (CPI), and unemployment ra...

Affiliate Program

Unlock Earning Potential

Empower your audience with cutting-edge prop trading. Partner with us as an affiliate and turn your network into a lucrative opportunity for financial growth.