Extended periods of time

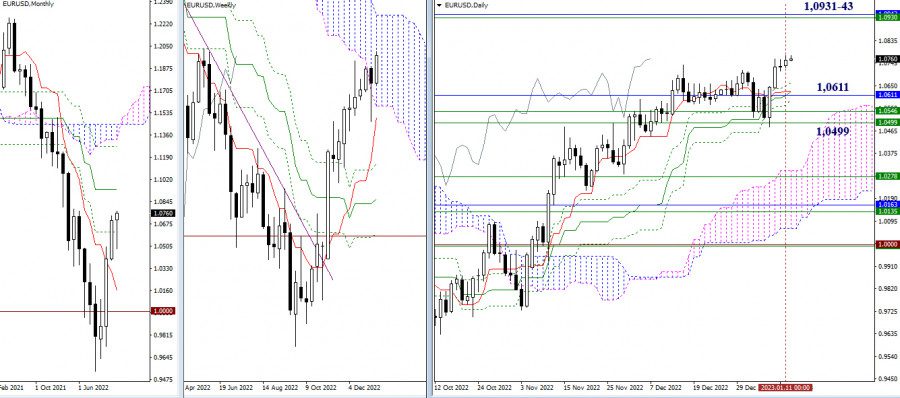

Yesterday, the bulls drove EUR/USD to a higher intraday peak, but the currency pair eventually ended the day with a minor increase. The nearest upside target is still 1.0931-43, which encompasses the upper part of the weekly cloud and a one-month trend line. If the currency pair begins a downward correction, the first obstacle is the daily Cross at 1.0664-29. Subsequent areas of support are 1.0611 and the weekly support at 1.0546-1.0499.

An image is presented depicting a graph of analytics. The illustration shows a rising trend in the data, representing the increasing nature of analytics over time.

H1 – H4

The EUR/USD pair has seen a slight ascent in the smaller timeframes in recent days, with the central pivot level at 1.0753 being the key support for the bullish move. If this move continues today, the resistance of classical pivot levels at 1.0779 – 1.0803 – 1.0829 will be tested. If the bears enter the market, their focus will be on breaking through the classical pivot levels at 1.0729 – 1.0703 – 1.0679, followed by the more significant support at 1.0673, a weekly long-term trend line.

Rather than copying the same words, one can modify the structure of the text while still maintaining its overall context and meaning. This can be done by rewording portions of the sentence, rearranging the order of ideas, or replacing some words with synonyms.

The British Pound against the US Dollar is nearing a significant technical support, leaving many to wonder if this trend will continue or if there will be a reversal.

An image of analytics is portrayed in the accompanying illustration. It is meant to represent the concept of data analysis in the present day.

Extended periods of time

The GBP/USD has come to a standstill, hovering near the 1.2142 mark on the daily chart. In the existing market environment, the bulls are hoping to achieve three objectives: the elimination of the intraday Ishimoku Cross at 1.2214, the testing of the 1.2302 – 1.2457 resistance area, and the adjustment of the price action.

If bearish sentiment increases, it is projected that the rate will exceed the support levels of 1.2076, 1.2025, 1.1933, and 1.1842. When the cost falls beneath those aforementioned levels, the asset has the potential to recover in the same manner as it did in December.

A picture depicting analytics can be seen below.

H1 – H4

Recently, the bulls are still dominating the market. However, GBP/USD has seen a downward correction. This correction appears to be supported by a long-term trend line of 1.2089. If the price drops below this line and continues in a downward trajectory, the balance of trade forces on smaller time frames could be altered. The key intraday levels to look at are 1.2063, 1.2025, 1.2181, 1.2219, and 1.2259. If the bulls are successful, they will most likely focus on these resistance points.

This text can be reworded to express the same thought in a different way by altering the structure and keeping the full context and semantic meaning intact. Maintaining the markdown formatting is important as well.

The concept of this technical analysis is rooted in the following concepts:

The Ichimoku Kinko Hyo (9.26.52) and Fibonacci Kijun levels are both used in longer timeframes.

H1 – Classic Points of Rotation and a 120-Interval Moving Average (A Long-Term Trend Line Over a Weekly Basis)