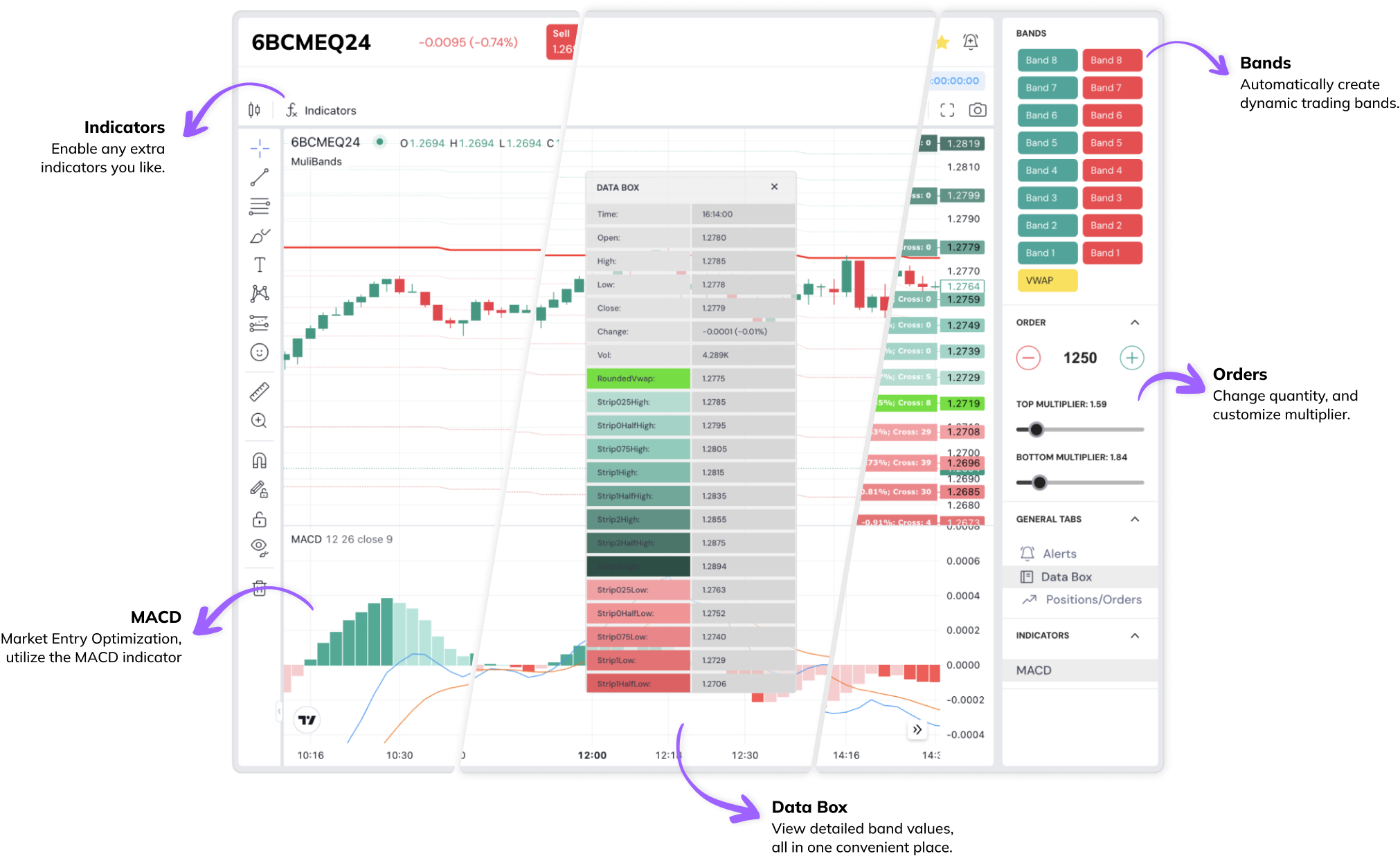

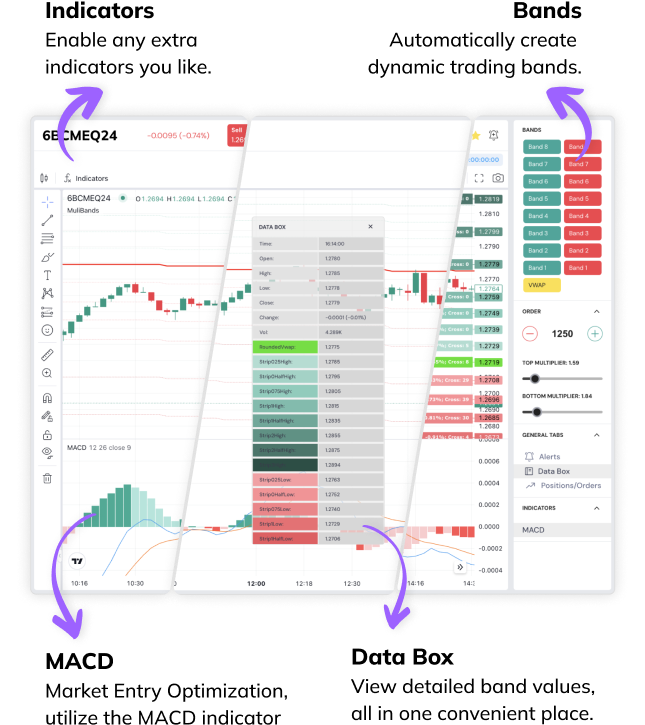

With Xstrategy, traders can automatically generate trading bands based on their personalized strategies, enhancing decision-making and improving trade performance. Discover how our tool can revolutionize your trading tactics.

Track Your Trades with Precision

Make Informed Trading Decisions

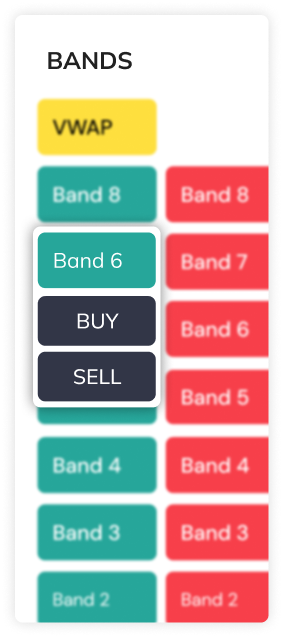

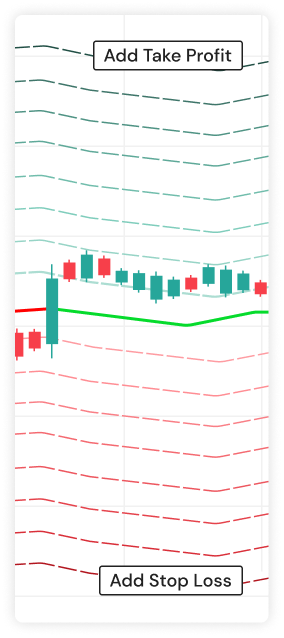

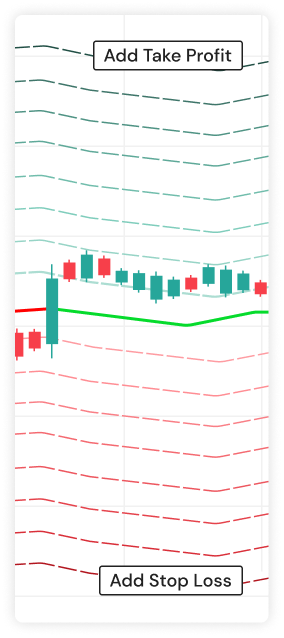

BANDS

Let Xstrategy

work for you

By automatically generating trading bands customized to your specific strategy.

These bands adjust in real-time, helping you optimize your trading positions and make more informed decisions.

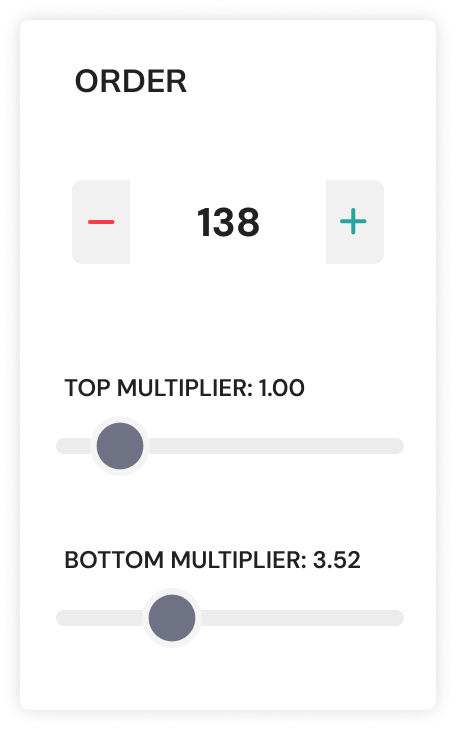

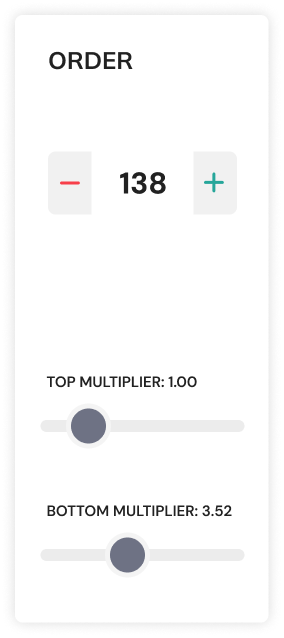

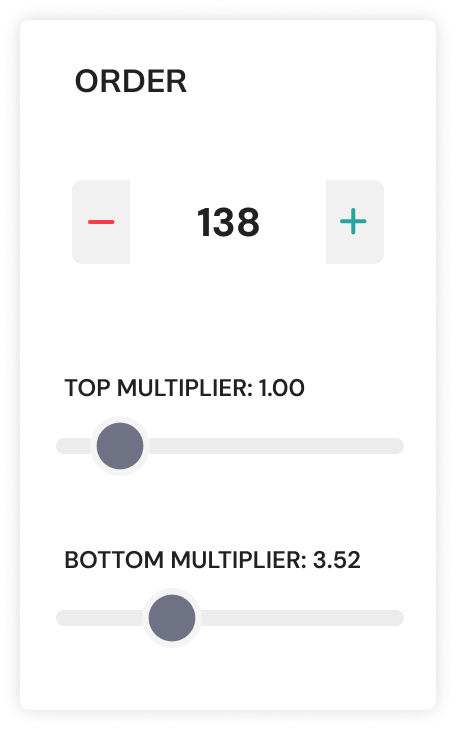

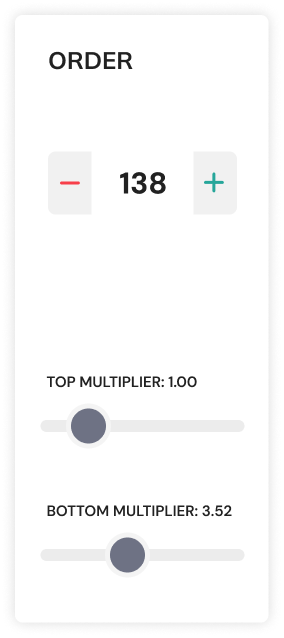

Multiplier

Fine-Tune with

Custom Multipliers

Take control of your trades with customizable multiplier settings.

Fine-tune both the upper and lower bands to adapt perfectly to market conditions, giving you the flexibility to sharpen your trading strategy.

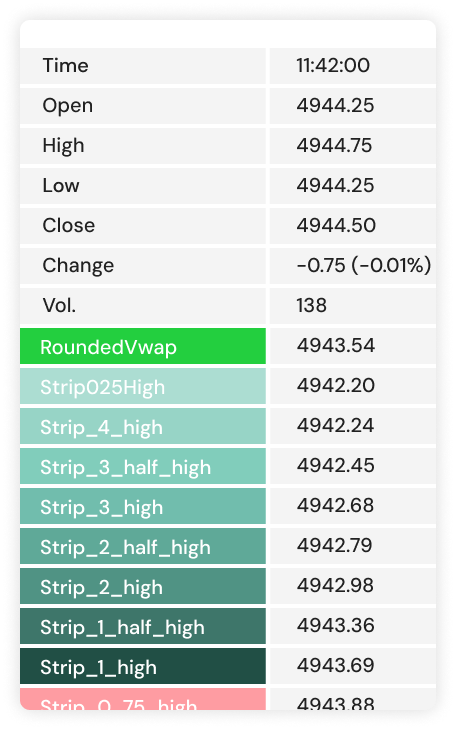

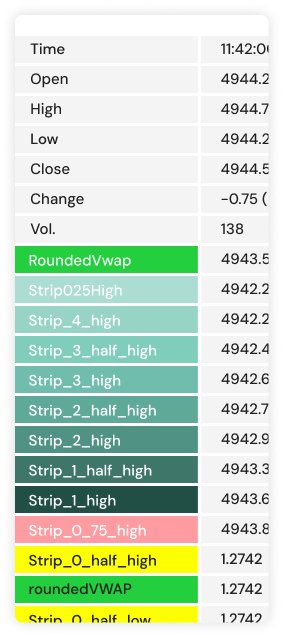

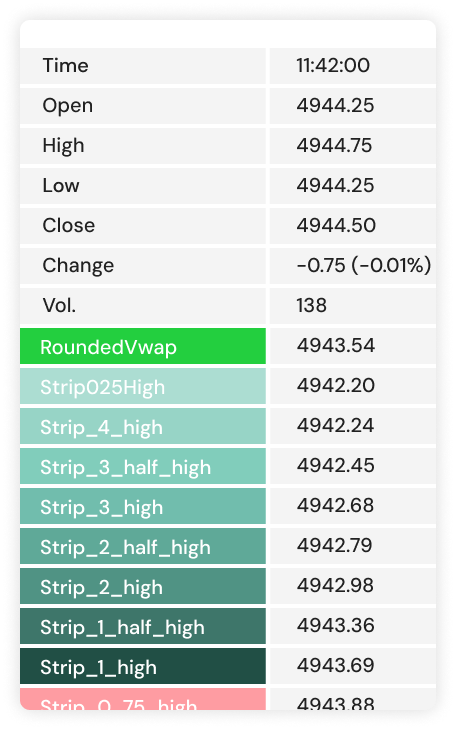

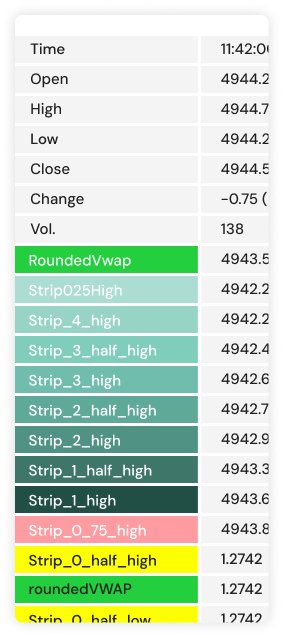

DATA BOX

Comprehensive Band

Metrics in One Place

Xstrategy provides detailed band values along with open, high, low, and close prices for every time interval.

Giving you a complete snapshot of the market at any moment.

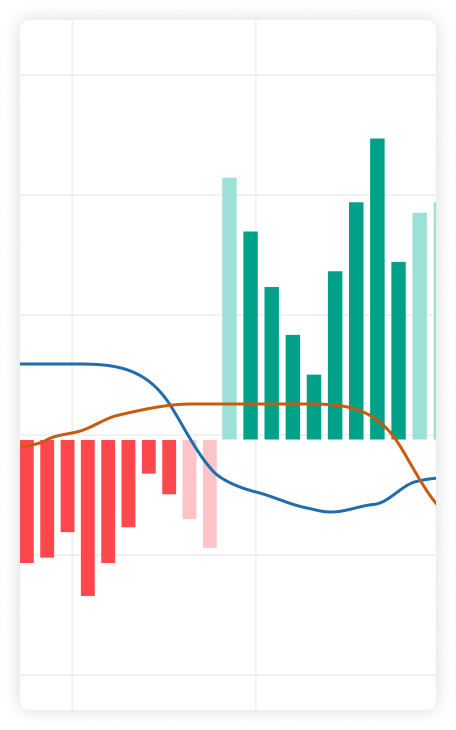

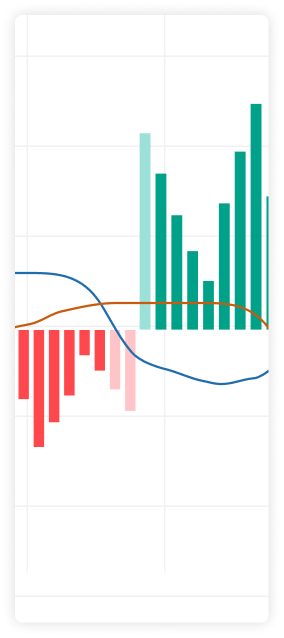

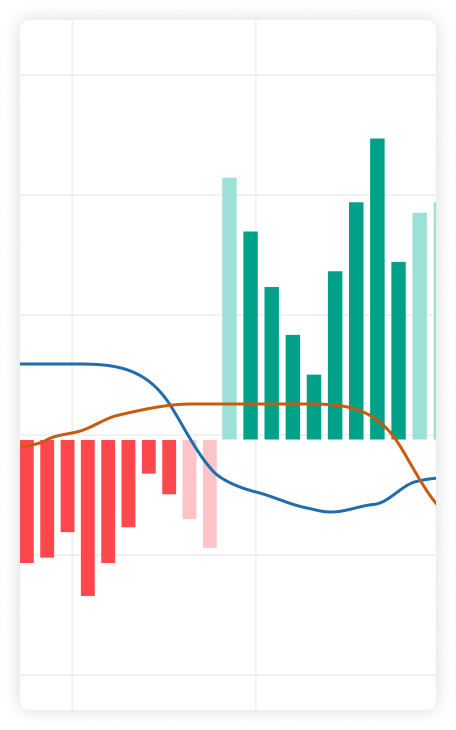

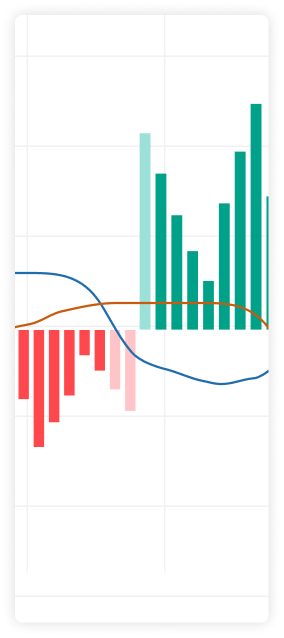

MACD

Maximize Efficiency

with MACD Integration

MACD (Moving Average Convergence Divergence) indicator helps you optimize your market entries and exits, improving your overall trading efficiency.

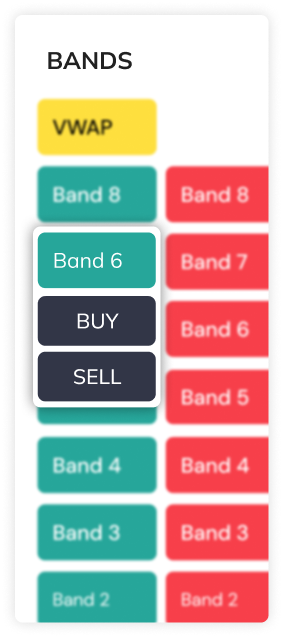

BANDS

Enhance Market

Insight with VWAP

Gain a deeper understanding of market trends with the Volume Weighted Average Price (VWAP) indicator.

Ensure your trades are in line with volume activity, giving you a competitive edge in analyzing price movements.

BANDS

Let Xstrategy

work for you

By automatically generating trading bands customized to your specific strategy.

These bands adjust in real-time, helping you optimize your trading positions and make more informed decisions.

Multiplier

Fine-Tune with

Custom Multipliers

Take control of your trades with customizable multiplier settings.

Fine-tune both the upper and lower bands to adapt perfectly to market conditions, giving you the flexibility to sharpen your trading strategy.

DATA BOX

Comprehensive Band

Metrics in One Place

Xstrategy provides detailed band values along with open, high, low, and close prices for every time interval.

Giving you a complete snapshot of the market at any moment.

MACD

Maximize Efficiency

with MACD Integration

MACD (Moving Average Convergence Divergence) indicator helps you optimize your market entries and exits, improving your overall trading efficiency.

BANDS

Enhance Market

Insight with VWAP

Gain a deeper understanding of market trends with the Volume Weighted Average Price (VWAP) indicator.

Ensure your trades are in line with volume activity, giving you a competitive edge in analyzing price movements.

Everything you need to know

xStrategy is an advanced tool that auto-generates trading bands and strategies tailored to your preferences. It allows you to adjust multipliers, utilize indicators like MACD and VWAP, and create personalized trading setups. xSstrategy is particularly useful for traders participating in trading challenges, as it helps you optimize trade performance by providing better entry and exit points, speeding up the process of achieving success in trading evaluations.

xStrategy can be seamlessly integrated with Webtrader in Trade Challenges. Once connected, the system will automatically sync with your account, allowing you to start automating trades based on your set preferences.

Yes, xStrategy caters to all experience levels. For beginners, it simplifies the process with pre-configured settings that work with default strategies. As you gain experience, you can adjust and customize the tool’s features to match more advanced trading strategies.

Yes! xStrategy is fully customizable. You can tweak parameters for Bands, Multipliers, MACD, and VWAP, allowing you to create personalized strategies suited to your trading style and risk tolerance.

xStrategy automates the process of identifying key trading opportunities by utilizing advanced features like dynamic trading bands and multipliers, allowing you to focus on strategy rather than manual trading decisions.

How it works?

StrategyX is designed for easy integration and immediate impact.

© 2024 Livemarkets.com - All rights reserved.