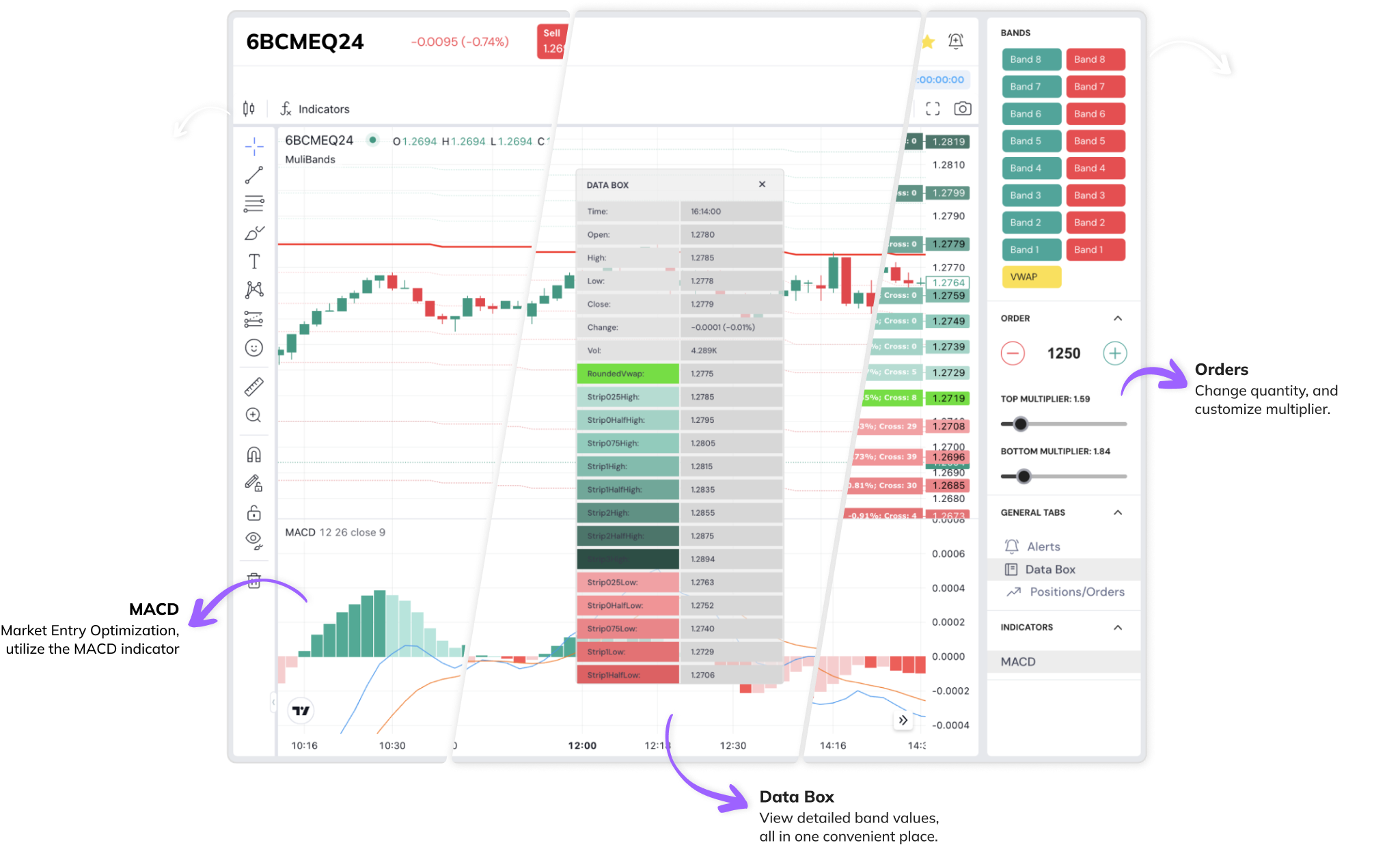

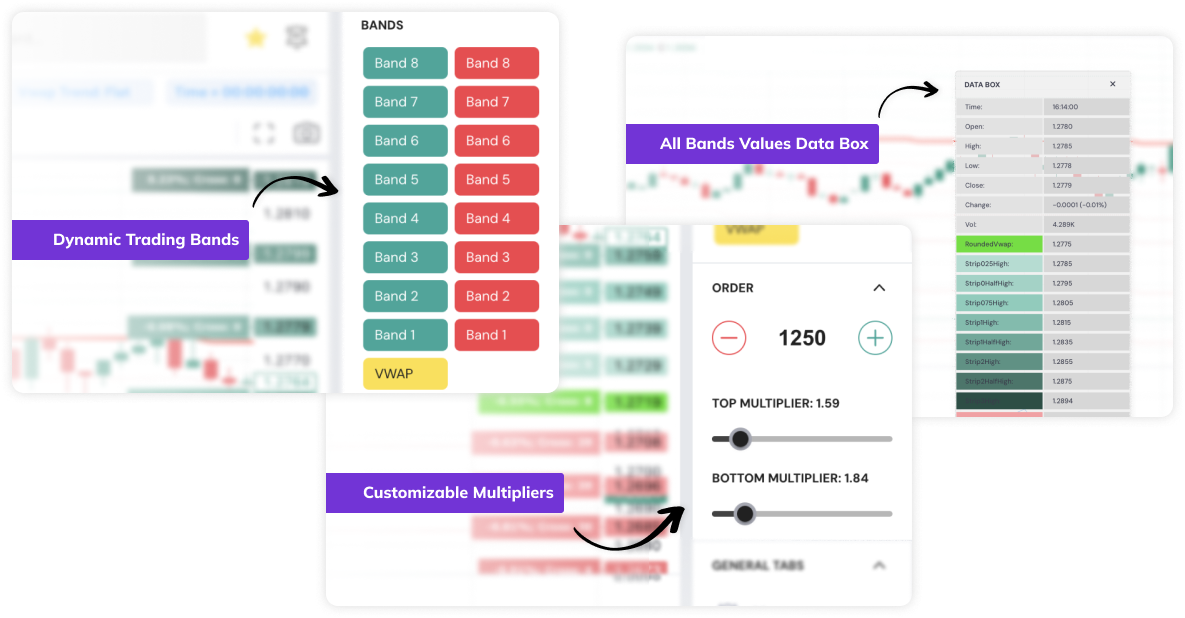

With Xstrategy, traders can automatically generate trading bands based on their personalized strategies, enhancing decision-making and improving trade performance. Discover how our tool can revolutionize your trading tactics.

Advanced Features for Advanced Results

Core Features of Xstrategy

How it works?

Elevate your trading experience with just a few simple steps.

StrategyX is designed for easy integration and immediate impact.

StrategyX is designed for easy integration and immediate impact.