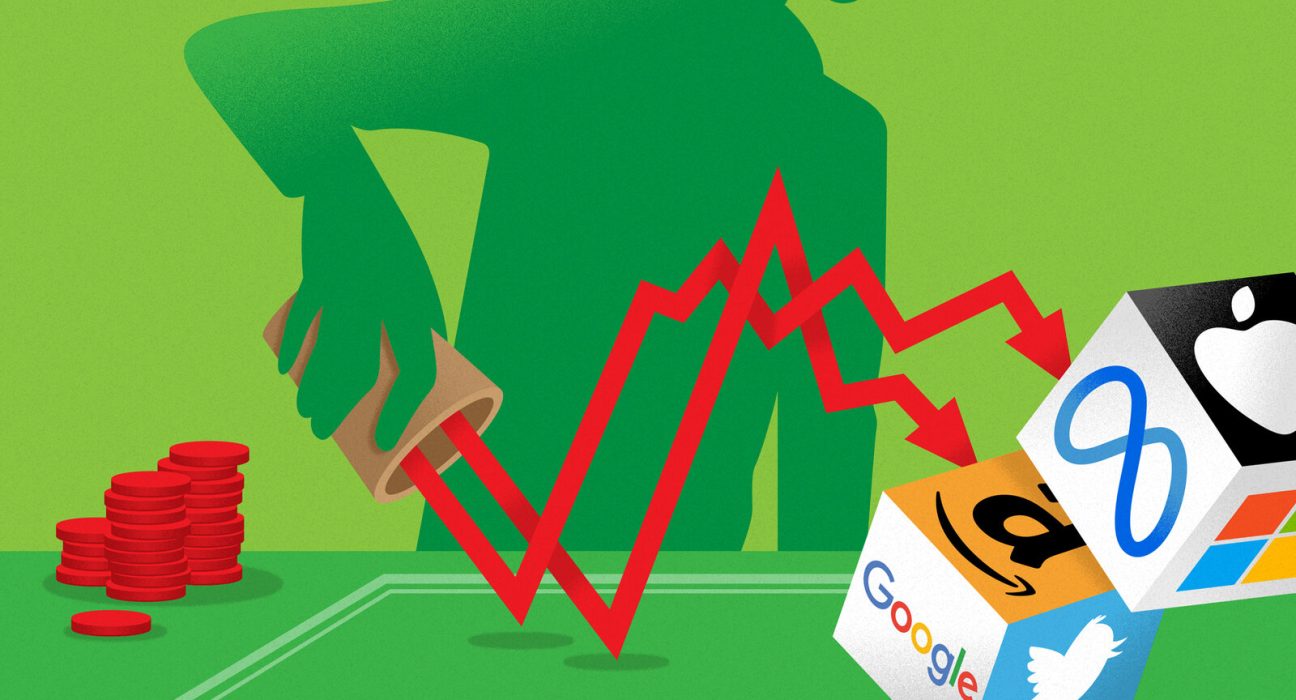

As the stock market enters a crucial phase, the upcoming earnings reports of seven prominent technology companies are poised to shape the trajectory of this year’s equity rally. Dubbed the “Magnificent Seven” by investors, these companies have witnessed soaring stock prices ranging from 40% to over 200% so far in 2023. Their remarkable performance has contributed significantly to the S&P 500’s 17% year-to-date rise, propelling the index to its highest level since April 2022.

With such exceptional gains, the market has set high expectations for the earnings of these seven companies: Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta Platforms. BofA Global Research projects that their earnings will increase by an average of 19% over the next 12 months, more than double the estimated 8% rise for the rest of the S&P 500.

However, these companies face the challenge of justifying their premium valuations. While the overall trailing price-to-earnings ratio for the S&P 500 stands at around 15 times, it reaches approximately 40 times when including these tech giants, according to BofA.

The results of these companies will likely have a significant impact on the broader market. The outsized gains of the “Magnificent Seven” have led to their domination of benchmark indexes, causing concerns for some active fund managers. In fact, these seven stocks currently make up 27.9% of the S&P 500’s weight.

Bill Callahan, an investment strategist at Schroders, highlights the importance of looking beyond the second-quarter results. He states, “It’s also how do these big companies, which are carrying the market… guide for the rest of the year and into 2024.” Investors are eagerly awaiting insights into these companies’ future plans and strategies.

According to Tajinder Dhillon, a senior research analyst at Refinitiv, the seven companies account for 14.3% of the estimated earnings for the second quarter and 9.3% of estimated revenue for the S&P 500 as a whole.

In the previous quarter, Nvidia stood out with its exceptional revenue forecast, surpassing expectations. The semiconductor company’s commitment to meeting the surging demand for artificial intelligence chips generated excitement in the market. Since the beginning of the year, Nvidia shares have soared over 200%.

Tesla is the first among the growth giants to report its earnings, expected on Wednesday. The company led by Elon Musk recently announced record vehicle deliveries for the second quarter.

Microsoft and Meta are among the companies set to report the following week, and investors are keen to learn about their strategies for harnessing the power of artificial intelligence.

While the benefits of AI may not be immediately visible for every company, investors are eager to understand how these technology giants plan to monetize this technology. Thomas Martin, a senior portfolio manager at Globalt Investments, explains, “It’s going to take some time for that to work its way through and to show up.” He emphasizes the importance of demonstrating progress along the way.

There are signs that market gains are becoming more widespread beyond the “Magnificent Seven.” The equal-weight S&P 500, which represents the average stock, has modestly outperformed the traditional S&P 500 over the past month. This shift reflects increased confidence in the economy’s ability to avoid a prolonged recession. A “soft-landing” scenario could boost cyclical stocks such as industrials and small-caps, which currently trade at more affordable valuations. However, many investors believe that the corporate giants will remain crucial holdings in portfolios. Yung-Yu Ma, Chief Investment Officer at BMO Wealth Management, highlights their significance, stating, “They have gone from a core holding of a portfolio to an almost absolute necessary major component of the portfolio once you factor in trends such as AI.”

As investors eagerly await the earnings reports of the “Magnificent Seven,” the stock market is at a critical juncture. The outcome of these reports will not only shape the market’s short-term direction but also shed light on the companies’ plans for the remainder of the year and beyond.