Introduction

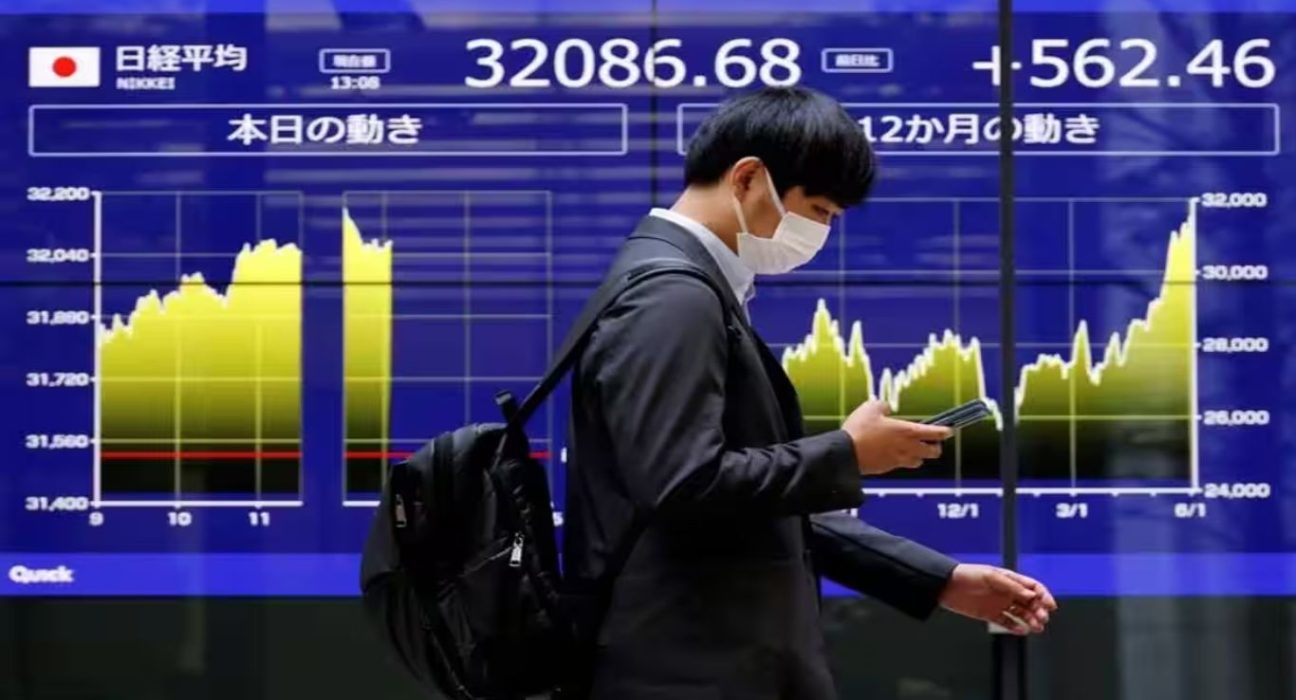

In a week characterized by market volatility, the MSCI Asia-Pacific index outside Japan displayed a marginal gain of 0.28% today. Despite this slight uptick, investors are bracing themselves for a potential 2% loss over the course of the week, signaling the index’s most substantial decline in over a month. This article delves into the underlying factors driving these fluctuations, offering a comprehensive analysis of the current market sentiment.

Market Analysis and Influential Factors:

The prevailing global economic uncertainty remains a pivotal factor contributing to the week’s market turbulence. As concerns persist regarding the resurgence of COVID-19 cases in various regions and its potential impact on economic recovery, investors have been adopting a cautious stance. This wariness is reflected in the index’s weekly performance, as the looming possibility of prolonged restrictions and supply chain disruptions affects investor confidence.

Geopolitical Tensions

Geopolitical tensions also play a crucial role in shaping market dynamics. Escalating tensions between major global players can trigger fluctuations in investor sentiment. As geopolitical concerns ebb and flow, the Asia-Pacific market is particularly sensitive to these shifts. The anticipation of potential disruptions to trade agreements and diplomatic relations can lead to increased market volatility, as observed in the current downturn.

Sectoral Performance

Analyzing the performance of various sectors within the Asia-Pacific region reveals another layer of insight into the market’s fluctuations. Some sectors are more resilient in the face of uncertainty, while others experience more significant impacts. Industries closely tied to consumer behavior, such as retail and hospitality, are prone to sudden drops due to shifts in consumer confidence. On the other hand, sectors related to technology and healthcare have shown more stability, cushioning the overall impact on the index.

Supply Chain Disruptions

The vulnerability of global supply chains has come into sharp focus during the ongoing pandemic. Disruptions in the supply chain, whether due to lockdowns, transportation restrictions, or labor shortages, can lead to production delays and reduced revenues for companies. These factors, in turn, affect stock prices and contribute to the index’s weekly losses.

Government Policies and Stimulus Measures

Government policies and stimulus measures continue to be integral to economic recovery efforts. The timely implementation of supportive measures can soften the blow dealt by external shocks and market uncertainties. Conversely, delays or inadequacies in stimulus plans can leave businesses and investors grappling with heightened uncertainties, impacting market performance.

Investor Sentiment and Behavioral Factors

Investor sentiment is deeply intertwined with market fluctuations. Emotions such as fear, greed, and uncertainty can drive rapid buying or selling decisions, amplifying market volatility. As the MSCI Asia-Pacific index outside Japan faces its most substantial weekly loss in over a month, analyzing investor sentiment becomes crucial in understanding the shifts in market momentum.

Conclusion

In conclusion, the MSCI Asia-Pacific index outside Japan’s 0.28% gain today provides a glimmer of positivity amid an otherwise turbulent week. As the index stares at a potential 2% weekly loss, various factors converge to shape its performance. Global economic uncertainty, geopolitical tensions, sectoral dynamics, supply chain disruptions, government policies, and investor sentiment collectively create a complex tapestry that defines market movements.

Investors and analysts alike are closely monitoring the interplay of these factors as they navigate the road ahead. While short-term fluctuations are inevitable, the broader trends in the Asia-Pacific market will ultimately be influenced by the trajectory of the global economy, the evolution of geopolitical dynamics, and the efficacy of governments’ efforts to stimulate economic recovery.