Introduction

In a significant development for both Country Garden, a Chinese property developer, and the beleaguered property sector, creditors have granted approval for an extension of payments on an onshore private bond. The bond, worth 3.9 billion yuan (approximately $540 million), was the subject of a crucial vote that concluded on Friday night. This decision holds immense implications, offering a lifeline to a company grappling with challenges and providing a glimmer of hope in the crisis-hit property landscape.

Country Garden’s Bond Extension Triumph

Country Garden, one of China’s prominent property developers, faced a pivotal moment as it sought approval from its creditors for an extension on a 3.9 billion yuan onshore private bond. The outcome of this vote was closely watched, given the tumultuous state of the Chinese property sector. The verdict, ultimately in favor of the extension, is a substantial relief for the company and the wider property industry.

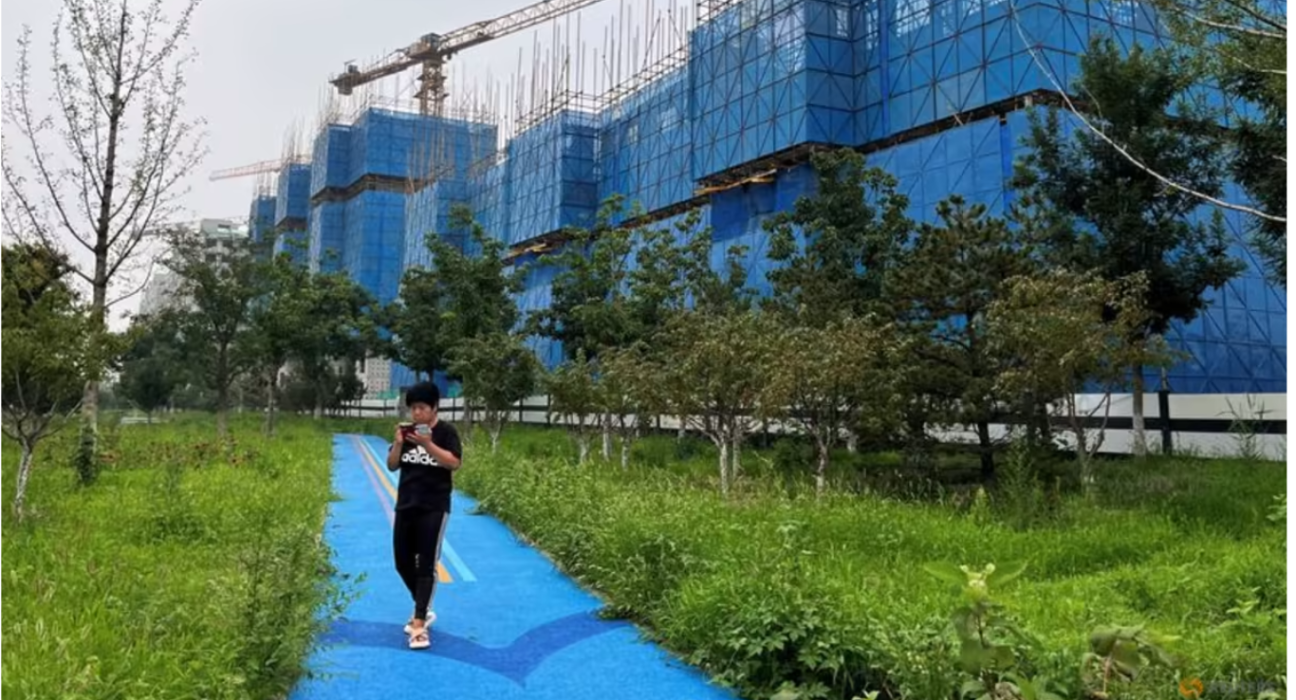

The Ongoing Property Sector Crisis

China’s property sector has been mired in a complex web of challenges, including debt burdens, tighter regulations, and a housing market slowdown. This environment has forced developers to explore unconventional measures to weather the storm. Country Garden’s bid to extend the maturity of its onshore private bond was a crucial move in this context.

The Significance of Creditor Approval

Securing creditor approval for a bond extension is not merely a financial maneuver but a lifeline for companies grappling with liquidity issues. In Country Garden’s case, this approval provides them with much-needed breathing room. It is a testament to the company’s ability to navigate treacherous waters in a highly competitive and challenging market.

Implications for Country Garden

The extension of the 3.9 billion yuan bond allows Country Garden to manage its debt obligations more effectively and allocate resources strategically. This move aligns with the company’s long-term vision and underscores its commitment to navigate through the ongoing property market turbulence.

Positive Signals for the Property Sector

While Country Garden’s success in securing creditor approval is a milestone for the company, it also sends positive signals to the broader property sector. The industry, which plays a pivotal role in China’s economy, has been grappling with a cascade of challenges. This approval indicates that financial institutions are willing to collaborate with developers to stabilize the sector.

Market Confidence and Investor Sentiment

The property market’s performance often hinges on investor sentiment and market confidence. Country Garden’s ability to gain creditor approval reflects a certain level of trust in the company’s financial stability and its capacity to navigate market headwinds. This could potentially rekindle investor interest in the Chinese property sector.

Looking Ahead: The Road to Recovery: Country Garden’s successful bond extension is a pivotal step on the path to recovery, but challenges remain. The property sector still faces regulatory scrutiny, debt pressures, and a shifting market landscape. However, this victory underscores the resilience and adaptability of industry players and their ability to persevere through adversity.

Conclusion

In a critical juncture for both Country Garden and the broader Chinese property sector, creditors’ approval to extend the maturity of a 3.9 billion yuan onshore private bond marks a significant turning point. This decision provides Country Garden with crucial breathing room, instills confidence in the property market, and reflects a commitment to weather the storm. While challenges persist, this development offers a glimmer of hope on the horizon for a sector seeking stability and recovery.