Introduction

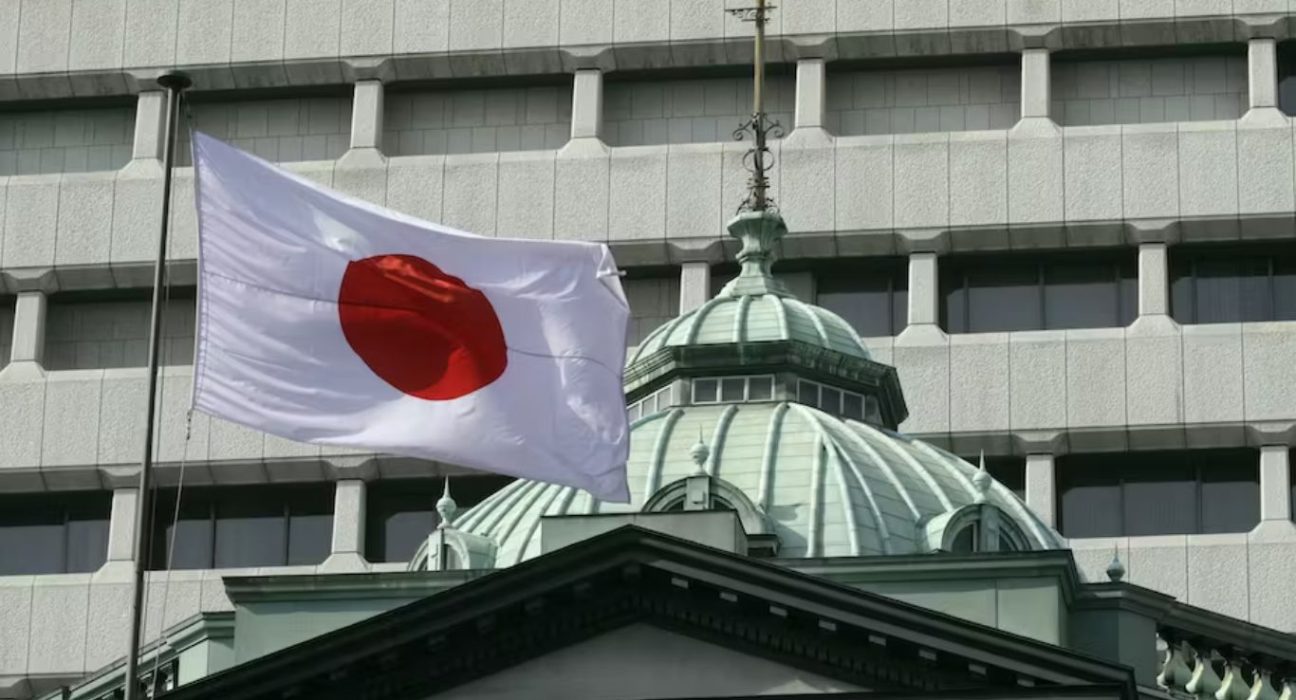

The Japanese government has projected a significant surge in inflation, surpassing the central bank’s 2% target for this year. The acknowledgment of broadening price rises raises speculation about the possibility of ultra-low interest rates coming to an end. Investors eagerly await the outcome of the upcoming Bank of Japan policy meeting, during which the board will discuss progress towards achieving sustainable price targets.

Rising Inflation Exceeds 2% Target

In a recent announcement, the Japanese government predicts a substantial rise in inflation, going beyond the Bank of Japan’s 2% target for the year. This development comes amid a period of increasing prices across various sectors of the economy. As consumers face the impact of soaring prices, there are concerns about the potential implications for monetary policy and interest rates.

Anticipation of a Market-Driven Interest Rate Adjustment

With inflation rates rising above the central bank’s target, there is growing anticipation that the era of ultra-low interest rates may be coming to a close. Market participants closely monitor the Bank of Japan’s policy meeting scheduled for next week, where they expect the board to review and adjust its quarterly forecasts. Any indication of a shift in the bank’s monetary stance could significantly impact financial markets and the overall economic landscape.

Bank of Japan’s Quarterly Forecast Revisions

The upcoming Bank of Japan policy meeting is of immense importance, as it provides an opportunity for the central bank to revise its quarterly forecasts. The bank’s projections will likely be influenced by the government’s inflation estimates and the prevailing economic conditions. Policymakers are also expected to deliberate on the progress made towards achieving sustainable price targets in their efforts to stimulate economic growth and curb deflationary pressures.

Sustaining Price Targets and Economic Recovery

One of the critical objectives of the Bank of Japan is to achieve stable and sustainable price growth. By maintaining inflation around 2%, the central bank aims to strike a balance that fosters economic growth while preventing runaway inflation that can erode purchasing power. The current inflationary pressures pose both opportunities and challenges as policymakers work to steer the economy towards a robust recovery.

Factors Driving Inflation Surge

The inflation surge in Japan is the result of multiple factors at play. Supply chain disruptions, increased production costs, and growing demand from domestic and international markets are some of the key drivers of rising prices. Additionally, fiscal stimulus measures implemented by the government to bolster economic activity have also contributed to inflationary pressures. Understanding these factors is crucial in formulating effective monetary policies to address the evolving economic landscape.

Balancing Monetary Policy and Economic Growth

As inflation continues to exceed targets, the Bank of Japan faces a delicate balancing act. On one hand, the central bank must consider scaling back the ultra-low interest rate environment to curb inflation and prevent asset bubbles. On the other hand, they must ensure that economic growth is not stifled prematurely. Striking the right balance requires a keen assessment of economic indicators, global market dynamics, and a clear understanding of short-term versus long-term impacts.

Impact on Consumers and Investors

The persistent inflationary pressures in Japan have far-reaching implications for consumers and investors alike. Rising prices can erode purchasing power and impact household budgets, potentially leading to changes in spending patterns. Investors also face uncertainty as they navigate a shifting economic landscape. In such times, diversified investment strategies and risk management become essential for safeguarding financial portfolios.

Global and Regional Ramifications

Japan’s economic performance has significant ramifications not only for the nation itself but also for the broader global and regional economies. As the world’s third-largest economy, Japan’s policy decisions and economic outcomes can influence international trade, financial markets, and investor sentiments. Therefore, the Bank of Japan’s policy meeting holds importance beyond national borders.

Conclusion

As Japan grapples with surging inflation and market expectations of a shift in monetary policy, the upcoming Bank of Japan policy meeting is closely watched by investors, businesses, and policymakers. Achieving sustainable price targets while supporting economic recovery remains a challenging task for the central bank. The delicate balance between controlling inflation and fostering growth will undoubtedly shape Japan’s economic trajectory in the months to come.