A picture of analytics can be seen below, providing an illustration of the concept. An image of analytics is also included for reference.

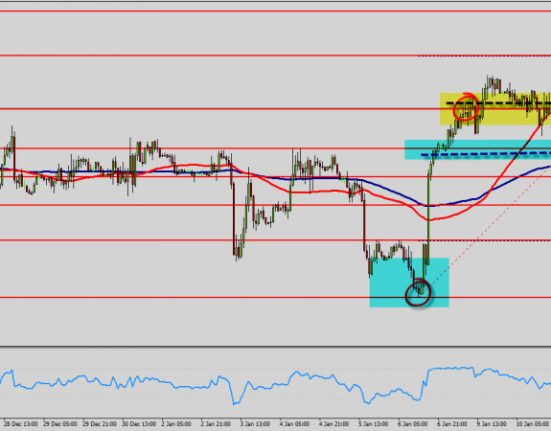

In the past, the GBP/USD currency pairing was under bearish pressure, which prompted it to test a brand new low of 1.2150 a few days subsequent.

Nevertheless, there was a notable area of support around 1.1850-1.1900 that had kept the bearish decline from continuing for a period of time.

Nevertheless, as the bullish impetus began to wane, further bearish movements were predicted to test a new all-time low near 1.0600 where a critical Fibonacci Extension was situated.

Previous articles had predicted that the bulls would remain in control if the ascending bottoms around 1.1150 and 1.1750 were defended, leading to further bullish progress above 1.1765.

Observing the market activity at 1.2340 for a bearish decline, traders took a short-term SELL position. The profits have been maintained despite the corrective uptrend which unfolded.

However, it is likely that a bearish pullback to the 1.1750 level will occur, offering a potential long-term BUY Entry with a goal of reaching 1.2350.