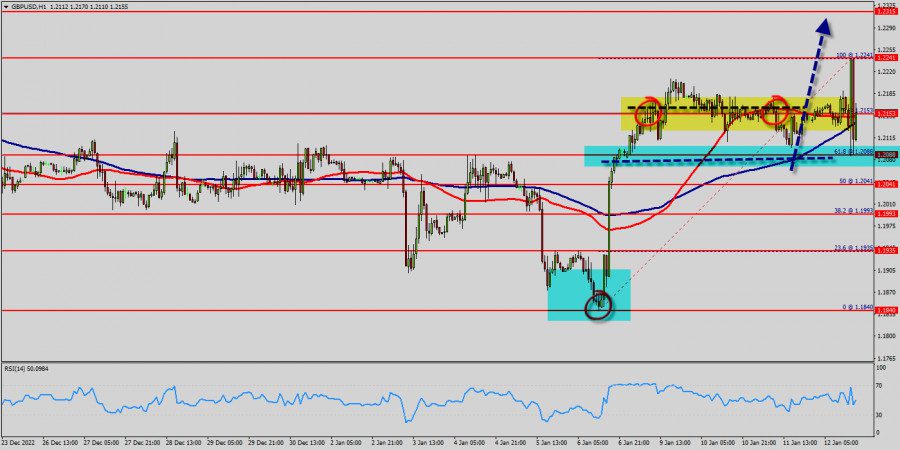

The GBP/USD currency pairing surged to the weekly pivot and opposition 1, as a result of a range of corresponding highs and lows. Ultimately, the pair scaled up to the point of 1.2088. Consequently, the primary resistance was established at the level of 1.2241. To add to this, the double top is also in line with the primary resistance this week.

The Relative Strength Index (RSI) is still suggesting a robust bull market and the present cost is above the 100 Moving Average. Therefore, investors should capitalize on the support level of 1.2088, with the initial target at 1.2241.

If the GBP/USD pair surpasses the weekly pivot point of 1.2088, it could lead to the currency set increasing towards 1.2241 to challenge the weekly resistance there.

This day, the GBP/USD has gone beyond the 1.2088 resistance barrier, which is now a support level.

At the 1.2153 mark, a minor support has been established by the pair. However, the 1.2088 level has emerged as a major support due to the fact that it is the weekly support 1.

It is essential to note that the RSI and 100 moving average are still suggesting an uptrend. Consequently, the market is showing a possible bullish prospect in the 1.2088 range on the hourly chart.

Furthermore, if the trend is looking up, the strength of the currency pair can be characterized as such: the British Pound is in an ascending trajectory while the American Dollar is dropping. Purchase above the minor support of 1.2088 and the first goal should be 1.2241, heading afterwards towards 1.2315 (the weekly resistance 2).

But, take heed of too much bullish momentum. It is wise to remain observant of any elevated bullish advances or scanner findings that may result in a minor bearish adjustment.

The British Pound to US Dollar exchange rate rose on the day and concluded near 1.2153. Over the course of the day, it varied between 1.2153 and 1.2315, keeping close to the end value of the day before.

The GBP/USD pairing has come across a robust support level at 1.2088, where the resistance shifted to become support. This strong support has been recognized at 1.2088 and the pair is probably attempting to reach it to test it once more.

For the week, the figure of 1.2088 is serving as a minor source of support. If one views the hourly chart of the GBP/USD pair, it is seen that the pair has crossed and stayed above the 100 hour moving average of 1.2153.

On the four-hour chart, the circumstances are comparable. As a result, it appears prudent to maintain a bullish approach in trading. As long as the GBP/USD pair is above MA 100 H1, it is wise to look for openings to purchase in order to create a correction.

The GBP/USD pair is still fluctuating between 1.2153 and 1.2315, and it is predicted to have a variation of +162 pips in the impending hours.

Conversely, if the market price dips below the minor support, the ideal place to set a stop loss order is 1.2315 or lower; then, the trend will reverse and the price will drop towards the robust support at 1.2088 where it will be tested again.

Additionally, the value of 1.2041 will make a double bottom. It is important to consider the stop loss, therefore it would be advantageous to put the stop loss below the previous bottom at 1.2041.